Shareholders

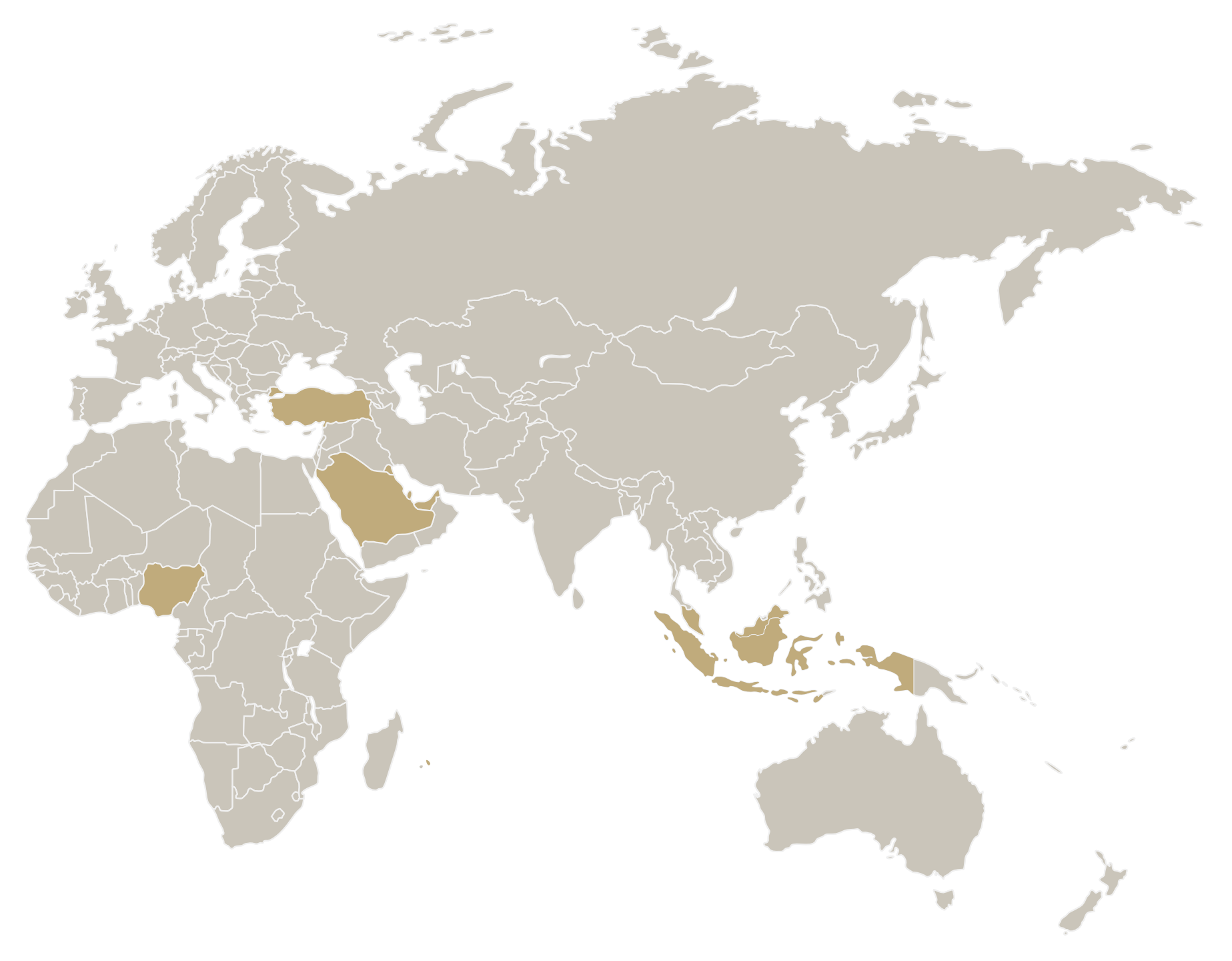

THE IILM CURRENT SHAREHOLDERS

The source of our strength is a diverse group of founding shareholders comprising central banks, monetary agencies as well as a multilateral organisation. The current member shareholders comprise the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates and Islamic Corporation for the Development of the Private Sector (private sector arm of the Islamic Development Bank).

Bank Indonesia

Bank Indonesia (BI), established in 1953, serves as the central bank of the Republic of Indonesia with a primary objective of achieving and maintaining a stable rupiah. BI is dedicated to ensuring monetary and financial system stability, promoting an efficient and secure payment system, and supporting sustainable economic growth. Through its prudent regulatory practices and policies, BI manages the nation’s currency, oversees financial institutions, and fosters financial inclusivity.

Bank Negara Malaysia

Bank Negara Malaysia (BNM), established in 1959, serves as the central bank of Malaysia, playing a pivotal role in maintaining monetary stability and fostering a sound financial system. BNM is committed to promoting economic growth and safeguarding the nation’s financial integrity through prudent regulatory practices and effective financial policies. The bank’s key functions include managing the country’s currency, overseeing financial institutions, and ensuring a stable payment system. Renowned for its leadership in Islamic finance, BNM actively contributes to the global development of Sharia-compliant financial products and services.

Islamic Corporation for the Development of the Private Sector

The Islamic Corporation for the Development of the Private Sector (ICD) is a multilateral development financial institution that supports the economic development of its member countries. Based in Jeddah, ICD is a part of the Islamic Development Bank (IsDB) Group and was established in November 1999. ICD’s mandate is to provide financing for private sector projects in member countries, promote competition and entrepreneurship, and encourage cross border investments. ICD also brings additional resources to projects, encouraging the development of Islamic finance, attracting co-financiers and enhancing the role of the market economy.

Bank of Mauritius

The Bank of Mauritius, established in 1967, is dedicated to ensuring the stability of the Mauritian financial system and fostering sustainable economic development. As the country’s primary monetary authority, BOM’s responsibilities include formulating and implementing sound monetary policies, managing foreign exchange reserves, and overseeing the financial sector. Committed to innovation and financial inclusivity, the Bank of Mauritius plays a pivotal role in maintaining monetary stability, promoting economic growth, and safeguarding the integrity of the nation’s financial system.

Qatar Central Bank

Qatar Central Bank (QCB), established in 1993, is the central bank of the State of Qatar, responsible for maintaining monetary stability and ensuring the robustness of the financial system. QCB’s core functions include formulating and implementing monetary policy, regulating and supervising financial institutions, managing the country’s foreign reserves, and ensuring a secure and efficient payment system. Committed to fostering economic growth and financial stability, QCB plays a pivotal role in supporting the nation’s development goals and maintaining the integrity of its financial sector.

Central Bank of Nigeria

The Central Bank of Nigeria (CBN), established in 1958, serves as the central bank of the Federal Republic of Nigeria. CBN is responsible for maintaining monetary and financial stability, promoting a sound financial system, and supporting sustainable economic growth. Key functions of the CBN include formulating and implementing monetary policy, regulating and supervising financial institutions, managing the country’s foreign exchange reserves, and ensuring an efficient payment system. Committed to fostering economic development and financial inclusivity, CBN plays a crucial role in the nation’s economic progress and financial sector integrity.

Central Bank of the Republic of Türkiye

The Central Bank of the Republic of Türkiye (CBRT) is primarily responsible for steering the monetary and exchange rate policies in Türkiye. Founded in 1930, CBRT is tasked with maintaining price stability and supporting financial stability. The CBRT’s key responsibilities include formulating and implementing monetary policy, regulating and supervising the banking sector, managing the country’s foreign reserves, and ensuring a secure and efficient payment system. Through its commitment to transparency and effective communication, the CBRT aims to foster sustainable economic growth and uphold the integrity of the Turkish financial system.

Central bank of Kuwait

The Central Bank of Kuwait (CBK), established in 1968, serves as the primary monetary authority of the State of Kuwait. CBK is dedicated to maintaining monetary stability, ensuring the soundness of the financial sector, and promoting sustainable economic growth. The bank’s key functions include formulating and implementing monetary policy, regulating and supervising financial institutions, managing the country’s foreign reserves, and ensuring an efficient payment system. Through its prudent regulatory practices and policies, the Central Bank of Kuwait plays a vital role in safeguarding the integrity of the nation’s financial system and supporting its economic development.

Central Bank of the United Arab Emirates

The Central Bank of the United Arab Emirates (CBUAE), established in 1980, is the primary monetary authority of the UAE. CBUAE is responsible for maintaining monetary and financial stability, promoting a robust financial system, and supporting sustainable economic growth. The bank’s core functions include formulating and implementing monetary policy, regulating and supervising financial institutions, managing the country’s foreign reserves, and ensuring an efficient payment system. Through its commitment to innovation and regulatory excellence, the Central Bank of the UAE plays a crucial role in the economic development and financial integrity of the nation.